Accounting for cloud computing implementation costs begins with answering a few key questions

If you're a startup looking to keep overhead low and flexibility high, you're likely already considering cloud computing. Leveraging cloud computing platforms saves you from having to create software and infrastructure from scratch, which can generate significant savings for your young business. But when it comes time to put these numbers on the books, accounting for cloud computing implementation costs can become confusing.

Luckily, the International Financial Reporting Standards (IFRS) Committee issued guidance in March 2021 to clarify the process. As a result, tallying up the implementation costs for cloud computing can be as simple as answering a few questions. This guide will walk you through the current guidance so you can harness cloud computing without sacrificing financial prudence.

Jump to a section…

Cloud Computing: Licenses vs. Services

Implementation Costs for Cloud Computing Service Contracts

Accounting for Cloud Computing Implementation Costs in Action

Cloud Computing: Licenses vs. Services

Software-as-a-service, platform-as-a-service, infrastructure-as-a-service — despite their differences, all three fall under the umbrella of cloud computing arrangements (CCAs). Accordingly, one can generally break down all three (and any other configuration) into licenses and services. There are many important distinctions between the two, not least of which is how you should account for their associated costs.

Licenses

Under some cloud computing arrangements, the cloud computing company transfers a license to the software they provide in addition to hosting that software. If you aren’t sure whether your service provided a license, consider the degree to which you can control the software. If you can alter the code to add features or change functionality, you likely have a license.

In that case, you can apply accounting International Accounting Standards (IAS) 38, which covers Intangible Assets. Intangible assets are therein defined as identifiable non-monetary assets without physical substance, such as computer software and licenses. These assets will probably bring future economic benefits, and their costs can be reliably measured. This critical distinction allows you to capitalize any directly attributable cloud computing implementation costs that arise from preparing the software for use. To capitalize a cost is to include that cost in the value of an asset and expense it over the course of the asset’s useful life. Spreading the cost out can improve the health of your books when investing in cloud computing, and that can make the process of migrating to the cloud a little easier. However, there are many other moving parts to consider. Such a migration requires a comprehensive project plan, training staff on necessary skills, and more.

Are you cloud migration ready? Cloud migration can set the foundation for your organization's future. Make sure you're prepared and compliant with our free checklist:

Implementation Costs for Cloud Computing Service Contracts

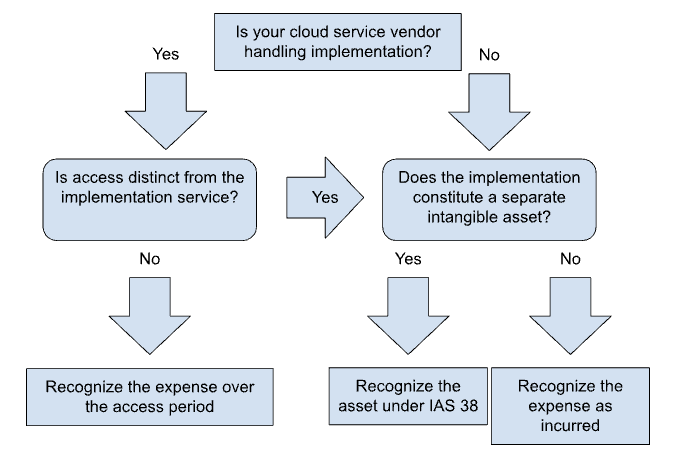

Licenses are rare in cloud computing implementations, as most cloud computing providers don’t want you noodling around in their code. As a result, it’s unlikely your business will be able to capitalize these expenses. Instead, you’ll likely sign a service contract giving you access to — but not control over — cloud computing infrastructure. In this case, you will have to recognize expenses as they’re incurred, meaning the cost of the infrastructure goes on the books right away rather than over the course of its useful life span. In the process, you’ll have to answer another question fundamental to accounting for cloud computing implementation costs: Is access to the cloud service itself distinct from its implementation? In other words, do you need the vendor, specifically, to configure the solution it provides, or would you get value out of simply having access to the solution?

This framework should help you maintain your books correctly when it comes time to pay for cloud computing implementation costs:

Accounting for Cloud Computing Implementation Costs in Action

Let’s look at an example. Say Company X has decided to make use of cloud computing from Supplier Y. Supplier Y will provide access to the service for five years at a rate of $500 per year. Supplier Y has also agreed to configure the software for Company X for a $300 fee. Over the course of implementation, Supplier Y meets additional feature specifications for Company X, but retains the IP rights to the customized software and the ability to offer these features to other customers.

In this case, Company X does not control the software. As a result, it knows it has a service contract and not a license, which in turn means it cannot capitalize any cloud computing implementation costs. However, because Supplier Y did bespoke work for Company X in the implementation process, the service and its implementation become a single, indistinguishable offering — no third party could have performed the implementation in Supplier Y’s stead. That means Company X can recognize both the $500 yearly access fee and the $300 implementation fee over the course of the service tenure. That lets it amortize the implementation fee over the five years, putting $60 from it on each year’s accounting. All told, Company X records yearly cloud computing implementation costs totaling $560.

How DuploCloud Can Help

However you account for it, migrating to the cloud is easier with DuploCloud’s help. We designed our DevOps-as-a-Service no-code/low-code automation platform to be your DevOps Autopilot, making it fast and easy to build out the infrastructure configurations you need. Industry best practices, airtight security, and up-to-date compliance protocols undergird our platform, empowering you to rapidly map your current infrastructure and move it to the cloud with minimal downtime. Get in touch today to learn how DuploCloud can cut costs and migration times for your business by up to 80%.